Some cents this rainy season...

Reminiscing the time my parents are still here. October is my father's death anniversary, Mom's birthday is November, Dad's birthday is in December then my mother's death anniversary is in January. Maybe that's the reason why I am so sentimental during ber months. Adding up the on-and-off typhoon these past few weeks.

While we are growing up, I can still vividly remember how our parents always discuss to us the value of money. From how to be responsible in dealing with money, how to learn how to save, and even how to responsibly spend it. That we are not rich but we can change the manner in which we value money.

My father always told us that when we study hard and finally graduated, we will definitely have a good job to sustain us and that is the time we can buy whatever we want. It was instilled in my mind until I graduated. But let me share the reality. He was right but I must admit, it is not as easy just like when my father used to tell us.

I find myself overwhelmed with the real world. I finally graduated and got a good job, but that doesn't mean I can really buy whatever I want. I struggle with how to survive each month, wherein I have to deal with my own expenses and budget the money I am earning during that time.

Moving forward, I aged and outgrow the overwhelming issue of money. I learned how to spend wisely now, from overspending to conservatively spending. In line with this, I have been into so many trial and error experiences. I used tracking apps, website calculators, and the like. Joined group forums, and watched videos to learn more about my finances.

So here are some of the Money Facts I learned that I guess I should share with everyone.

Live within your own phase

Be Resourceful

Since I left my corporate job. I didn't want to just stay at home and do nothing. Before resigning, I tried to research online jobs and even tried applying to make sure I have some fallback after leaving my job. Well, to be fair, there are so many opportunities that you can find over the internet. Gone are the days when we are all requiring a nine-to-five job to say it's a decent job. Aside from looking for online jobs, I tried maximizing my online presence. From there I learn that I can still make money with my blog. So yeah, I earn something from my social media channels. It's not a big amount like those of the celebrities but at least I am earning from it. Not expecting much but it's a passive income. I earn from it while enjoying writing and doing content. If you want to learn more about how I do it, feel free to shoot me a message. Adding up my social media list below (shameless plug), lol.

Spend Money for your loved ones but include yourself

Before, I used to be guilty whenever I buy something for myself. I am fond of buying for my family with the thought of they deserve it more than anyone in the world. But as I get older, I learned to reward myself too. Now, whenever I reached a certain goal or earned from some work. I treat my family and include myself too. May it be going out, eating altogether, or buying something on my list. Yes, I have a list of what I want to have so whenever it's time to reward myself, I know what I already want.

Make sure to know your needs and wants and which should be prioritized so you would not be broken. You can split the expenses from one month to another. Know that it is not always time for a reward, so make sure it will not hit your budget.

Make a budget list

I am an accountant but before I don't really apply it to myself. Oftentimes I feel that there is no need for me to track my own expenses as long as I can live within my earnings. Whenever I know that I am over budget before, I just tend to say to myself, Oh hey, Jona, next payday is coming. Yes! But that was before when I am not responsible for my earnings and expenses.

Before I get married, I actually used excel sheets during the time we are planning the wedding. Probably that was the time I started to track each and every expense we make because for me there is another party involved and I don't want it to be the start of some misunderstandings or trust issues. And mind you, I regret all the times that I didn't get to do that. The old me is blaming myself for not doing that earlier.

Make the most out of the Internet

Since there is already an internet, everything is readily available and there is no excuse that you cannot have something or learn something. So this is not about money or finance education only, it applies to everything. Just like what I have mentioned above, be resourceful.

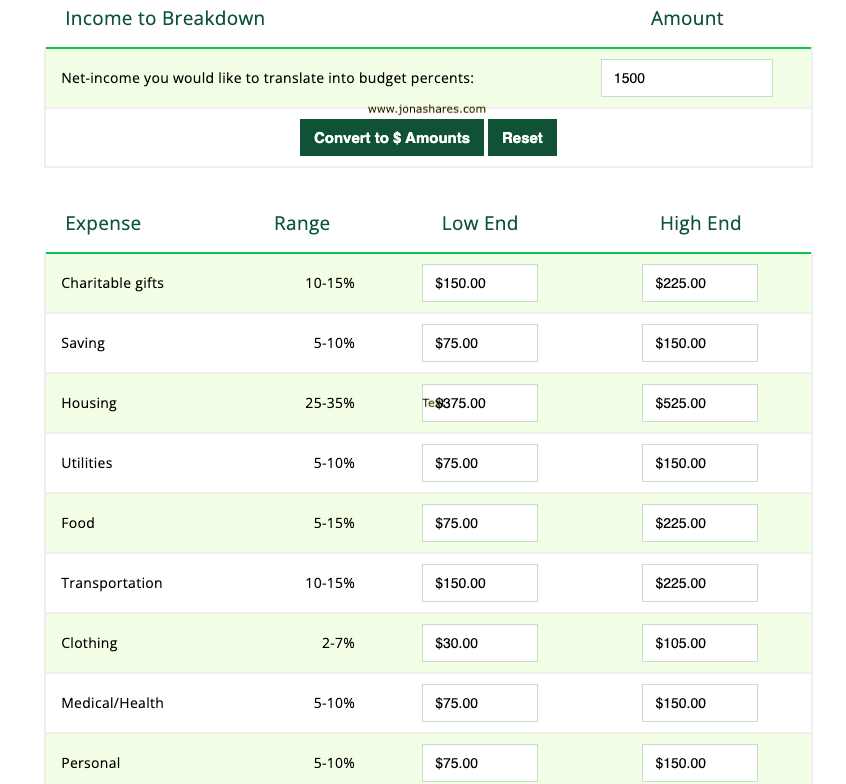

Not only I learned from watching videos but I found good resources which can really help me on tracking my finances. For me, using online calculators really works well on me. I see to it that I integrate it with my monitoring file especially when it involves a big amount of money. I love how it works and you can also play on the numbers.

Whenever we are planning to buy something or there would be a big amount of money involved, I make sure I get to see which will be more beneficial. I play around with the amounts involved, if we will be getting a loan or if we will be using our savings, which will cost much, and whatnot.

Websites such as Calculator.me take into account your current financial plans, and current interest rates for loans or rates when it comes to savings. You can use different calculators depending on your needs. Here is an example whenever I want to check for an eye bird's view of our financial plans. You can set a target net income and then it will provide a range of amounts for possible expenses. From here you will already get an idea of the particular amounts.

.png)

.png)

.png)

.png)

No comments:

Post a Comment